|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warranty Vehicle Insurance: A Comprehensive Coverage GuideExploring warranty vehicle insurance can be overwhelming, especially for U.S. consumers seeking reliable vehicle protection. Let's break it down into digestible pieces, highlighting the peace of mind and cost savings this coverage offers. Understanding Warranty Vehicle InsuranceWarranty vehicle insurance, also known as an extended auto warranty, is a service contract that covers specific repair costs after the manufacturer's warranty expires. This type of insurance is designed to protect you from unexpected expenses, offering significant benefits for those who drive frequently or own high-maintenance vehicles. What's Covered?

Choosing the right warranty can make a significant difference, especially for drivers in states like California, where repair costs can be notably high. Benefits of Warranty Vehicle InsuranceHaving warranty vehicle insurance means more than just repair coverage. Here are some key advantages:

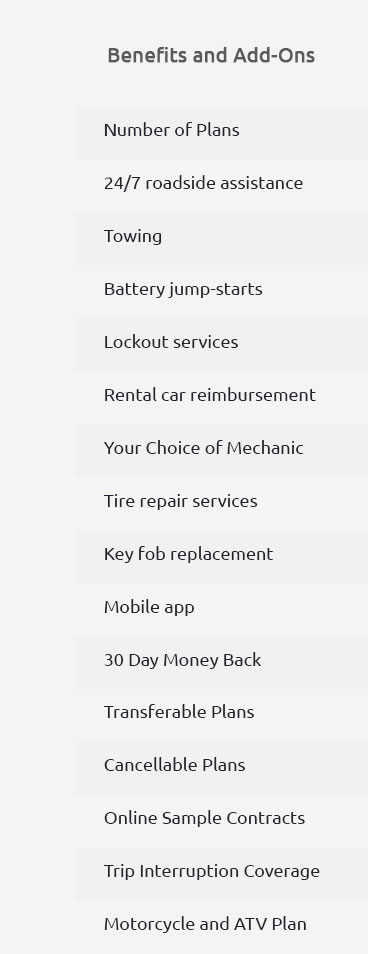

Considering different options? Check out this extended car warranty companies list for more information. How to Choose the Best PlanSelecting the right warranty vehicle insurance requires careful consideration of your driving habits and vehicle type. Factors to Consider

For expert advice, visit the best extended car warranty company to learn more about top-rated providers. Frequently Asked QuestionsWhat is the difference between an extended warranty and vehicle insurance?An extended warranty covers repair costs for specific parts after the original warranty expires, while vehicle insurance typically covers damage from accidents or theft. Can I purchase a warranty vehicle insurance plan after my car's original warranty has expired?Yes, you can purchase an extended warranty even after the original warranty has expired, although options may vary based on your car's age and condition. Are all repairs covered under warranty vehicle insurance?Not all repairs are covered. Routine maintenance and wear-and-tear items are usually excluded. Always check the specific terms of your plan. Exploring warranty vehicle insurance can offer you peace of mind, knowing you're protected from unexpected repair costs wherever your travels take you across the U.S. With the right plan, you can enjoy the open road without worry. http://www.assurant.com/partner-with-us/vehicle-protection-services

Protective Auto Warranty and Insurance Solutions - Assurant is your trusted partner for automotive solutions - Vehicle Protection Services Overview - Your Business. https://www.libertymutual.com/insurance-resources/auto/car-insurance-vs-warranty

Car insurance protects you after an accident whereas an auto warranty only applies to mechanical failures of your vehicle. https://www.nationwide.com/lc/resources/auto-insurance/articles/choosing-car-warranty

An extended car warranty will prolong the original warranty period or extend the mileage limit. For instance, a standard warranty ...

|